Sharif's Method for Determining the Critical Effective Rate of Intervention and its Application in Project Appraisal and in Decisions on Intervention

Die Sharif-Methode für die Bestimmung des kritischen Anteils der effektiven Intervention und ihre Anwendung bei der Projektbewertung und bei den Entscheidungen über Interventionen

طريقة شريف الخاصة باحتساب النسبة الفعالة الحرجة للتدخل وإستخدامها في تقييم المشروعات وإتخاذ القرارات بخصوص التدخل

Introduction

The Theory of the Real Effective Rate of Intervention

Sharif̄s Method and its Application

Introduction

Sharif had a unique experience in connection with the application of discounting techniques in project appraisal in developing countries. Research officers at the relevant planning and industrial ministries had been trained by the World Bank, UNIDO and other international organizations on the use of these methods but faced a serious dilemma when they applied these methods to selected strategic infant projects, since they often proved to be commercially unprofitable. The result was that since most of these projects were State sponsored, normally they were strongly recommended due to their viability to the national economy, officials wishing to endorse them had to resort to manipulating the estimated values of production costs, the domestic prices of output and the rate of capacity utilization in order to make them appear commercially feasible on paper.

During his work on different UNIDO projects, Sharif saw that some of UNIDO international experts faced the same dilemma when applying the discounting techniques. For instance, in a UNIDO study on Somalia there was a question of either using solar power or diesel for pumping. It was felt that the use of diesel would be the most uneconomic from a national point of view, because of continuous dependency on imported capital goods and oil products. Solar power, a natural and renewable source, seemed to be preferable and the equipment required for its use do not wear out as quickly as that required for diesel power. The UNIDO expert hoped by applying the discounting technique which UNIDO had recommended he would be able to prove the advantage of the solar solution. However to his surprise, despite the use of free and renewable sources and the fact that operating costs would be lower, he found that solar pumping would be disadvantageous.

During his work on different UNIDO projects, Sharif saw that some of UNIDO international experts faced the same dilemma when applying the discounting techniques. For instance, in a UNIDO study on Somalia there was a question of either using solar power or diesel for pumping. It was felt that the use of diesel would be the most uneconomic from a national point of view, because of continuous dependency on imported capital goods and oil products. Solar power, a natural and renewable source, seemed to be preferable and the equipment required for its use do not wear out as quickly as that required for diesel power. The UNIDO expert hoped by applying the discounting technique which UNIDO had recommended he would be able to prove the advantage of the solar solution. However to his surprise, despite the use of free and renewable sources and the fact that operating costs would be lower, he found that solar pumping would be disadvantageous.

Often we see in developing countries regions with fertile soil, water resources and favorable climatic conditions where the people rely on imported milk, eggs and chicken. In such a region everyone would tell you that in the olden days this region was well known for the production of those products that are being imported today. How could we explain why the poor in a developing country prefer to buy an imported chicken than to produce it by himself and why the discounting technique favors the wrong irrigation technology? The problem faced by developing countries is connected with the "international relative price system". The price of the imported chicken which is produced on the basis of low cost mass production principles is less than the required cost for raising such chicken locally. In the olden days of pre capitalism, raising chickens in the today's industrialized world was just as expensive as in the developing country in question. In the case of solar pumping, this alternative becomes uneconomic because of the larger initial investment and the high interest rates prevailing in the international capital market. As we see her we are confronted with outside factors, which we usually referred to as the "international relative price system". This system is a "defacto" imposed on individual producers under the conditions of free trade.

Under the circumstances of globalization, industrialized countries began to face a similar phenomenon which is faced by developing countries. In these countries we see, for example, jobless qualified people and abandoned factories.

The question now is under what circumstances chicken breeding and solar pumping would become profitable? The use of solar pumping implies a national benefit. The problem is how to make it profitable for domestic users? In order to enable the choice of appropriate technology to coincide with the national benefit, a shift from the "international relative price system" must be made by means of appropriate measures, such as tariffs and subsidies, which are at the disposal of the Government. The efficient application of these measures can only be determined on the basis of the theory of Protection.

Sharif noticed that the solution could not be found in the theory of the effective rate of protection, which was developed by W.M. Corden of Oxford University. On the basis of this theory we are supposed to be able to calculate how much protection must be given to the farmer so as to make the business of chicken breeding profitable and the application of solar pumping favorable. In this way the theory of Oxford would show a resource pull effect. This means investment would flow to those economic activities which receive higher rates of effective protection. But if this theory is capable of reflecting the resource pull then why was the effective rate of protection not applied to overcome the deficiency of the application of discounting techniques in developing countries?

After a thorough survey of the relevant literature Sharif came across the findings of Frank, Kim and Wesphal on the basis of an empirical study. They found that there is an absence of casual relationship between the scale of effective rates and source pull. (Charles R. Frank, Jr., Kwang Suck Kim and Larry E. Westphal, Foreign trade regimes and development, South Korea, New York: Colombia University Press for NBERE, 1975, P 206.)

The absence of a method for determining the need for intervention leaves no other choice to policy making authorities in developing countries but to resort to trial and error technique which usually results in huge economic losses. This also explains why the officials wishing to endorse the projects had to resort to manipulating the different estimated values. These officials face the same problem faced by the chicken breeder. The Government is absolutely ignorant about how much and what kind of protection should be offered to the chicken breeders so as to promote this industry and how much protection should be offered to the users of solar pumping so as to make its use most favorable. The same applies to the strategic projects. The planners need to find out how the Government should intervene so as to encourage the development avoid losses generated by strategic industries.

The Theory of the Real Effective Rate of Intervention

Sharif's Method for Determining the Critical Effective Rate of Intervention was derived from his theory "the real effective rate of intervention" which was presented in his book "Introduction to the theory of protection (1990)". This theory is considered as a major breakthrough in economic sciences. Sharif revealed the misconception of the theory of "the effective rate of protection", which failed to provide an empirical proof of a causal relationship between the scale of protection and the strength of resource pull.

The idea of effective rate of protection goes back to 1905 where an Austrian economist Schüler presented the first relevant arithmetical example. Later Mead, Barber, Balassa, Basevi, Soligo and Stern contributed to the development of the effective rate. W.M. Corden of Oxford University finalized the development of this theory which was presented in his book The Theory of Protection. Oxford: Clarendon Press, 1971.

Sharif’s theory of "the real effective rate of intervention" comprises a scientific criterion for estimating the real need for protection. Sharif's method is based on this criterion. This method guarantees an optimal intervention because it makes the profitability of individual producers coincide with national benefit.

The Sharif method is not only significant for economists but for decision makers, planners, administrators, engineers, research workers, development aid workers and all those engaged in the process of decision-making on industrial development. A special interest has been shown recently in Sharif's method by economists from industrialized countries. The application of this method enables finding an optimal intervention in saving affected industries by the current crises.

Sharif's Method and its Application

Let us assume that the Government in a given country aims at encouraging the development of a given strategic Industry j which is internationally non-competitive. This means that the relevant financial evaluation would be discouraging for investment in this industry. The financial evaluation is based on the investment criterion, which is determined by means of the ratio between the profit and the capital invested.

A policy making authority can evaluate the level of the domestic producers' competitiveness on the basis of the ongoing rate of interest in the capital market by adding the premium for entrepreneurial efforts and risks. We will denominate it as Ṝj.

Investing in the strategic industry j is not attractive because it is internationally non-competitive. This means that the pre-direct intervention rate of return of this industry Rj' would be less than Ṝj and hence the possible return on the same amount of capital invested elsewhere would be higher.

Now the problem which would face the decision maker is how much protection is needed so as to make investment in this industry attractive? Applying the effective rate of protection of Corden would not tell how much protection would be required so as the new industry becomes competitive. The ranking of the effective rate of protection of Corden is not linked directly to the profitability of producers. An internationally non-competitive producer of leather products, for example, might need little protection to become competitive where as a new car maker might require much more protection to become competitive.

In the real live three types of intervention measures are applied: These are price, cost and direct profit measures. Tariffs and quotas are classical examples of price measures. Labor subsidy, under- and overpriced utilities and preferential credits are typical examples of cost measures. Export subsidy, preferential rate of exchange and exemption from taxes are typical examples of profit measures.

The decision maker has to decide in every case on the most appropriate intervention measures so as to encourage investment in the industry in question and in the same time provide for the best combination of production factors from national point of view. For example in the case of an export industry the provision of sufficient preferential rates of exchange and export subsidy might be considered as appropriate measures. In the case of import substitution industry a quota on the competing imported products might be considered as appropriate. In the case of scarcity of capital and abundance of labor, providing labor subsidy and imposing tariffs on imported capital goods might be considered as appropriate. The decision maker could introduce all possible innovations in this regard. For example in the case of existing unemployment in the field of health care, the Government could offer free “health care” to the employees of the strategic activity j and their families instead of labor subsidy, so as to increase employment and domestic production of the product j. A similar example is the provision of free education to children of certain industries. In this way the wages in the activity j could be reduced and the profit margin would be increased.

Sharif's Method starts by quantifying the Resultant Effect of Direct Protection (REDPj). The latter enables the determination of the value of the post direct intervention per unit profit. In the above mentioned publication an in depth analysis on the tools of intervention and the quantification of their individual effects and their resultant effect is provided along with examples on the determination of the Critical Effective Rate of Direct Intervention CERDIj. In the following we will provide a summary of the main steps leading to the determination of the CERDIj.

REDPj + M'j = M''j

Where M'' is the post direct intervention per unit profit and M' is the pre–direct intervention unit profit.

ERDIj = REDPj/I'oj

Where I'oj is the per unit initial investment

ERDIj is the Effective Rate of Intervention in industry j

ERDIj = M''j/I'oj – M'j/I'oj = R''j–R'j

Where R''j is the post direct intervention rate of return and R'j is the pre–direct intervention rate of return.

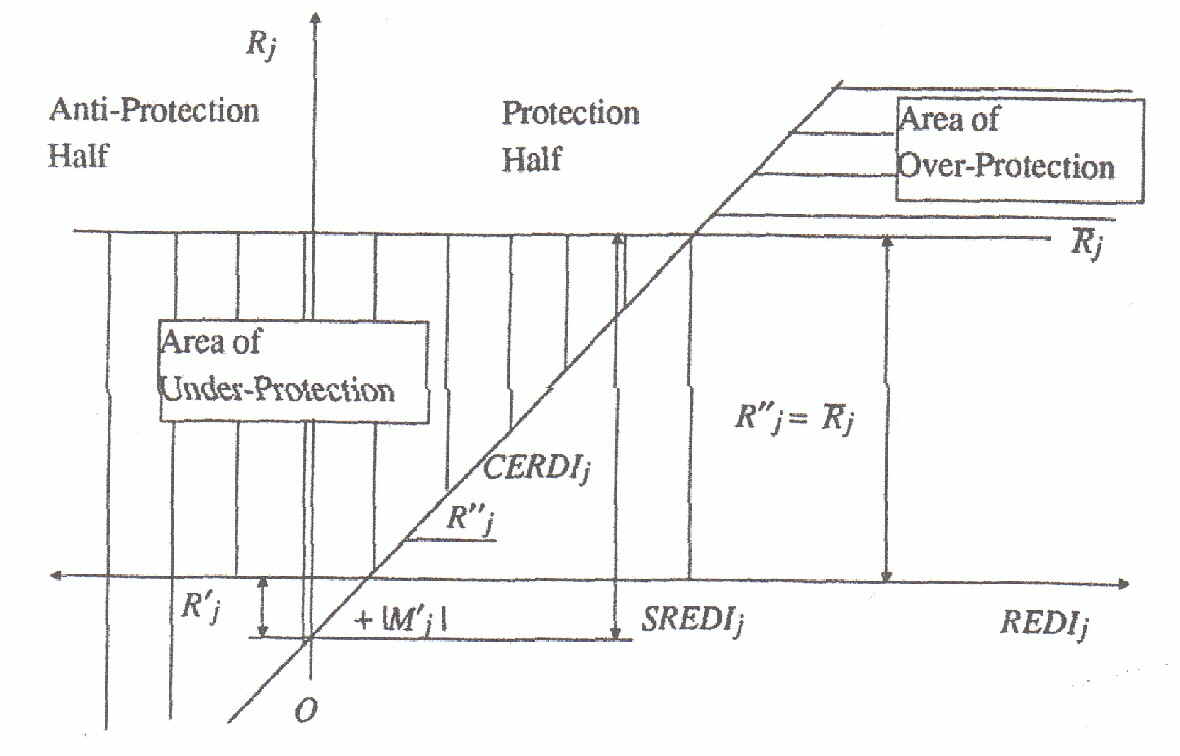

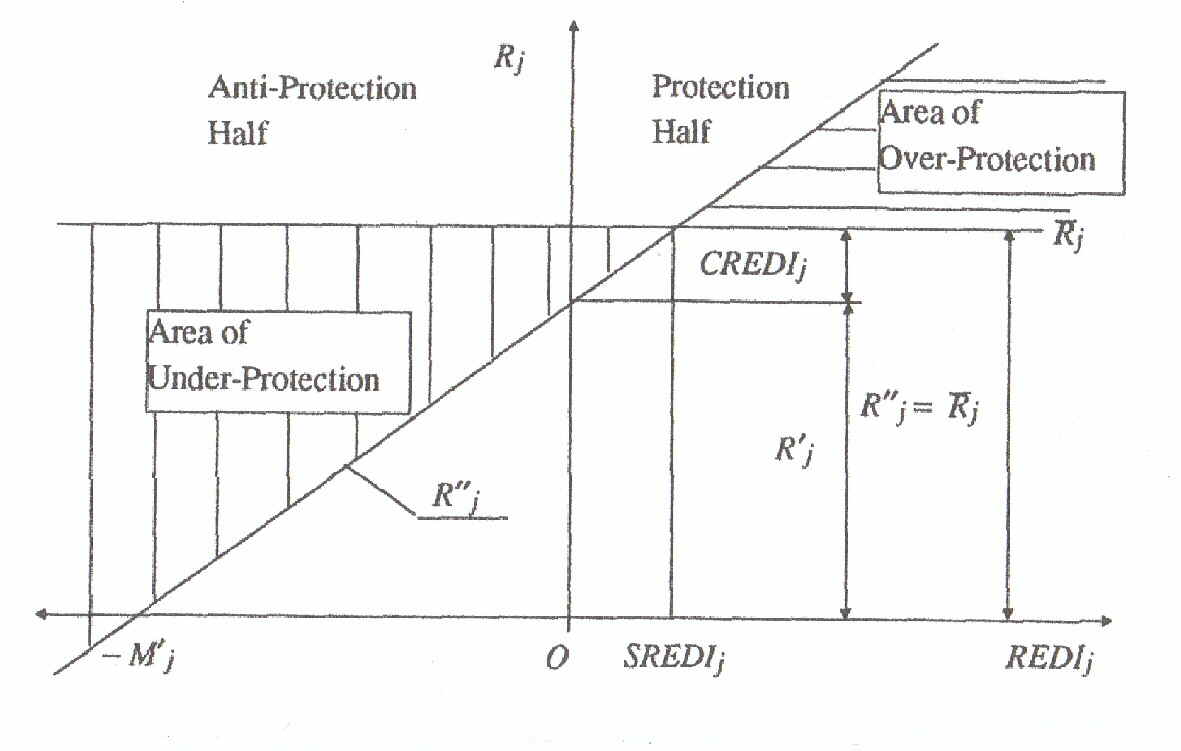

In order to encourage investing in the strategic industry j or to justify its own investment in this industry the Government must intervene in such a way so as to make the post direct intervention rate of return R''j equal to Ṝj. In this way the possible return on the same amount of capital invested elsewhere could be realized.

In order to avoid the problem of over- and under-protection the notion of Critical Effective Rate of Direct Intervention CERDIj was introduced.

CERDIj = Ṝj - Rj'

According to Sharif's Method the producer facing competitive disadvantage would be able to generate Ṝj after receiving a specific effect of direct protection (SERDIj). This means in the case when REDPj = SERDIj. So long the effect of intervention fall shorter than SERDIj, no resource pull would occur.

Increasing the profit margin by the amount SERDIj means increasing the pre-direct intervention rate of return Rj' to a post-direct intervention rate of return Rj'' which is equal to Ṝj. In this case the difference between Ṝj and Rj' is equal to the critical effective rate of return. If the Government provides Protection higher than CERDIj, then the producer would enjoy over-protection. This means converting public funds into private pockets.

The post-direct intervention rate of return Rj' constitutes a function of the Resultant effect of direct intervention EEDIj. The two figures below show in the cases of protection and anti-protection how providing CERDIj would lead to an optimal intervention.

Sharif's Lectures on Sharif's Method already released on You Tube:

Click Here To View On Youtube